Property4u.com

Property is the biggest item in your life and you shouldn't need to compromise.

The government give another round of cooling measures that took effect on Dec 16, 2021.

ABSD was raised across the board with Singapore citizens paying 17% for their 2nd property. Total debt serving ratio (TDSR) threshold was reduced by 5 percentage points to 55 per cent.

An estimated of 24 private residential projects were launched for sale, 12 were in the prime location or Core Central Region (CCR), 7 in the city fringe or Rest of Central Region (RCR) and 5 in the suburbs or Outside Central Region (OCR).

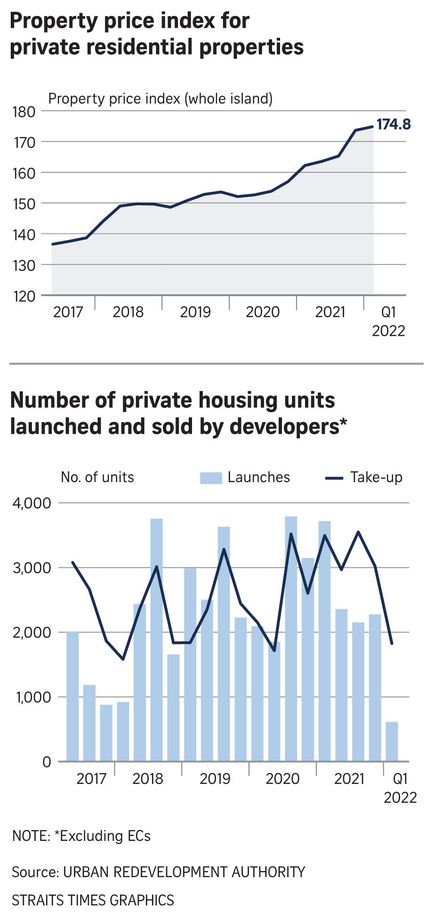

Last year, developers launched 10.496 private housing units and sold 13,027 units. The sales figure was about 30% higher than 2020. This caused the number of unsold units with planning approvals to 14,333.

Demand for new homes in 2021 come from the need to have a bigger space due to flexible work arrangements. Investors who made some winnings from the financial markets and like to switched their focus to a physical asset like property.

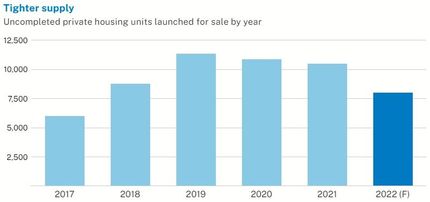

Lower supply of new non-landed private homes in 2022.

When the Covid-19 pandemic struck Singapore in 2020, the supply under the Government Land Sale (GLS) confirmed list was further cut in H2 2020 to 755 private housing units. This has resulted in lower supply of private homes in 2022.

The GLS and Enbloc sale markets started to offer more options in the 2nd half of 2021 when it become evident that the market needed more supply of land. These new launches on these sites are most likely to come to the market early next year.

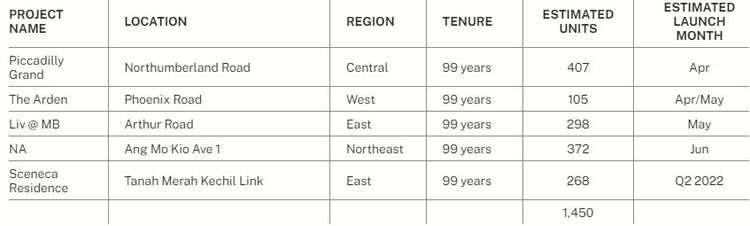

Likely popular non-landed private projects in H1 2022.

Piccadilly Grand, LIV@MB, The Arden, Ang Mo Kio Residences & Sceneca Residence

Major Launches in H1 2022 Coming Soon

Buy or Wait?

To buy or wait is likely the question on a lot of buyers' minds after the cooling measures. Studies have shown that price trends after July 6, 2018 cooling measures were relatively flat over 2 quarters before resuming their growth. Since then, prices have been on an upward trend and appreciated by 16.8 percent as of end of 2021.

The first major launch in 2022 after last December's cooling measures, Belgravia Ace saw more than 70 percent of its 107 units snapped up on the 1st day.

Given the volatile financial market and all-time high inflation on consumer goods, there is certainly a good incentive for property investors to take a look at property assets. Therefore these buyers are not willing to wait on the sidelines as they recognize a perfect opportunity to buy early before everyone. If history repeats itself, it means H1 2022 is likely the best time for buyers to enter the market before prices start to increase for the rest of the year.

Want to Learn More? Wait No More!

Sign Up to Learn More on What you Should Do as a Buyer in this Market

Thank you for connecting.

We will review your application and notify you if your application is successful.

Oops, there was an error sending your message.

Please try again later

Please try again later

© COPYRIGHT REAL ESTATE ADVICE 2022. ALL RIGHTS RESERVED

Contact Us

Call us:

+65 94359883

Where to find us:

205 Serangoon Central, Singapore, 550205, Singapore

Newsletter

Sign Up Now Copyright © All Rights Reserved.